FCB Canada launched its “Zero Barriers” campaign for BMO Financial Group which tell the stories of women BIPOC entrepreneurs who have found success in spite of societal barriers, biases and discrimination. The work highlights BMO’s investment in zero barriers to inclusion in the financial system.

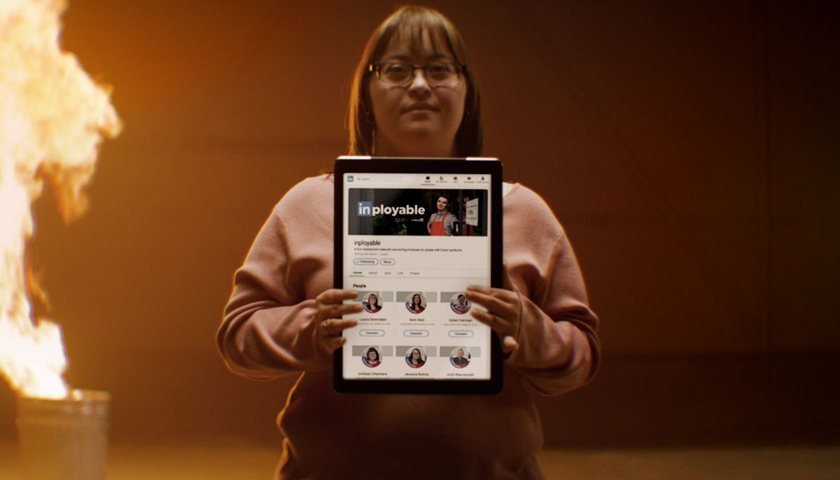

Timed to celebrate International Women’s Day and expanding on a social content series that launched in recognition of Black History Month, “Zero Barriers” shows the success of real women entrepreneurs from the BIPOC community. The stories celebrate the business owners’ strength and resilience while bringing awareness to the barriers that women of colour face in starting a business, from being undervalued to being underestimated.

The “Zero Barriers” campaign includes the “Barriers” video (one each for Canadian and US markets) which highlights the social issues and BMO’s commitment to change, as well as a documentary-style video and social content series called “Barrier Breakers” that demonstrate these ideas in action through the stories of real BMO business clients.

https://youtu.be/0X9IfKtwHLA

https://youtu.be/FezEvlHiyLk

Featured in “Barrier Breakers,” Co-Founders Kim Knight and Shanelle McKenzie of The Villij tell their story of the lack of visibility of women of colour in yoga studios and wellness spaces. ” During that time, when we first started in 2017, we didn’t see anyone like us,” said McKenzie “As first-time entrepreneurs, the barriers started almost immediately.” Knight added: “With the BMO grant, we are really able to build this platform – for not only women of colour in North America, but women of colour on a global scale.”

“The idea behind “Zero Barriers” is to imagine how business owners could thrive if the barriers in their way were dismantled and removed from a system of bias and discrimination,” said Nancy Crimi-Lamanna, Chief Creative Officer, FCB Canada. “They are succeeding despite these barriers, but they should be succeeding without them. More than ever consumers are engaged in dismantling inequity in their communities and they expect and demand that brands to do the right thing. BMO is committed to doing the right thing.”

Barriers – Stats & Personal Realities Are Staggering:

- Black women-owned businesses have grown by 322%, but have received 0.2% of funding. *

- Minority-owned businesses only get 1% of VC funding. **

- More than half of Indigenous entrepreneurs rely on personal savings alone to start up their business. ***

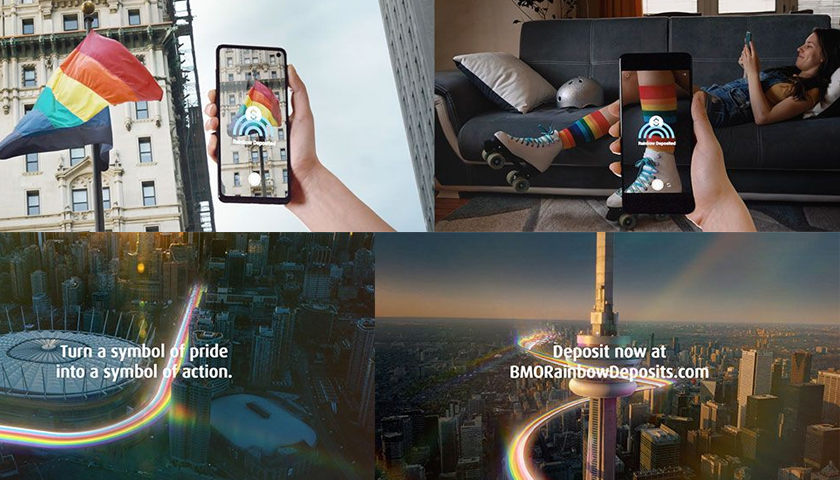

The Canadian Barriers and U.S. Barriers videos highlight BMO’s $3B commitment to women entrepreneurs in Canada and $800 million to women, Black and Latinx entrepreneurs in the US. The online campaign is part of BMO’s Zero Barriers to Inclusion 2025 launched in 2020 – the new, five-year, diversity goals to address gaps affecting Black, Indigenous, People of Colour, Latino, women and LGBTQ2+ employees, customers and communities.

“At BMO, we are committed to driving meaningful change and championing gender and racial equity in the financial system.” said Catherine Roche, Chief Marketing Officer and Head, Social Impact at BMO Financial Group. “This work celebrates the women who have overcome barriers to financial progress and demonstrates the action we’re taking to remove barriers to inclusion for our employees and communities.”